Protocol Overview

Governance

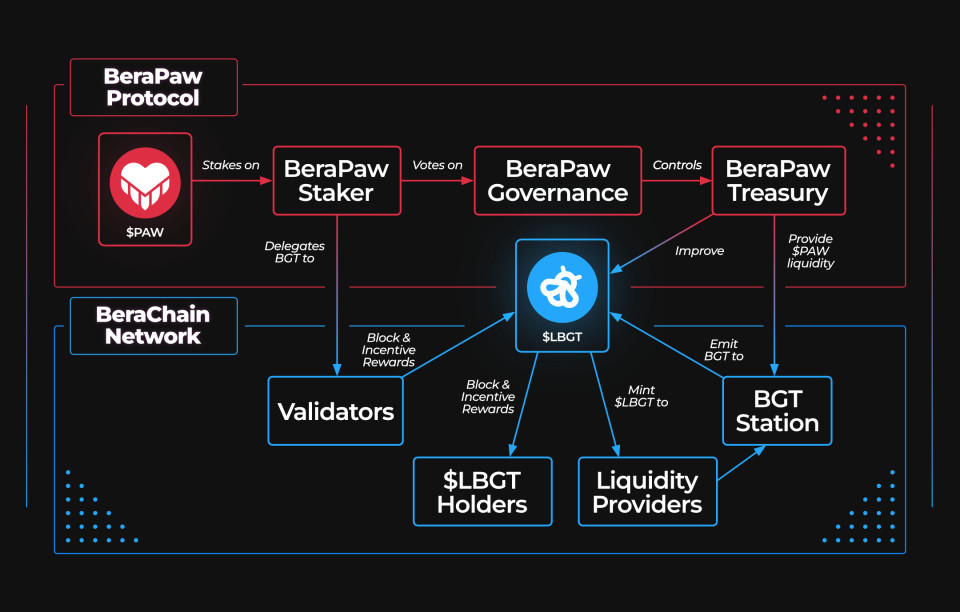

BeraPaw is a Decentralized Autonomous Organization (DAO) and $PAW holders are it’s owners. Through voting and proposal creation the owners will have control over protocol parameters and decisions about the future of BeraPaw. Users are required to stake $PAW to be able to exercise their governance power.

Treasury

Treasury assets are owned and managed by BeraPaw’s governance. Its primary function is to incentivize validators BGT emission and to provide liquidity for $PAW token. The treasury may at some point engage in other activities as long as the governance allows it.

LBGT

$LBGT is a token that abstracts BGT and make it transferable while also providing access to blockchain rewards and added utilities. $LBGT can be minted in a permissionless manner by claiming BGT to our contracts or redeemed for Bera. Every $LBGT backed by BGT in a 1:1 ratio.

LBGT Staking

When holders stake $LBGT they receive stLBGT as receipt, an index transferable token. Incentives and block rewards received from validator delegations are autocompounded into $stLBGT, that means that the user can participate in PoL and reinvest funds in a automated manner. Users can stake and unstake at any time without any accruing fees.

PAW

$PAW is BeraPaw’s governance token, a deflationary asset that represents a user share of BeraPaw DAO. $PAW must be staked in order have to receive protocol rewards or be used within BeraPaw.

PAW Staking

When holders stake their $PAW they receive stPAW and a receipt, a non-transferable token that allows the holder to receive protocol rewards, participate in BeraPaw’s governance, vote on the chain governance and choose the protocol validator delegation structure.

Liquidity Vault

[REDACTED]